Floor Rate And Peak Rate Under Gst

Gst rates of goods.

Floor rate and peak rate under gst. 22 nd gst council meeting. The hsn code is listed from 1101 to 1109 check the following gst rates hsn code chart. Decisions taken by the gst council in the 16th meeting. Wheat cereal flour malt starches wheat gluten.

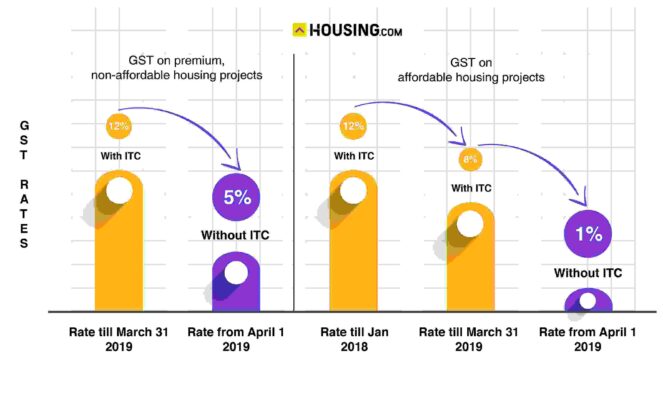

Igst exemption concession list as on 03 06 2017. In addition the council also cut the tax rate on ev charges to 5 from 18 at present. Gst acts cgst act 2017 as amended up to 30 09 2020. Developers of under construction projects could opt for the new or previous rate but now they have been asked to.

While due care has been taken in preparing this content the existence of mistakes and omissions herein is not ruled out. Chapter 11 gst rates and hsn codes of milling industry products i e. The gst rate hsn codes and rates have been arranged as per the best of authors understanding and are subject to periodic updates as per the law for the time being in force. The taxman has asked builders to choose before may 10 the new goods services tax rate for ongoing realty projects the concessional rate which came into effect april 1 was set at 1 for affordable houses and 5 for others from the earlier 8 and 12 respectively.

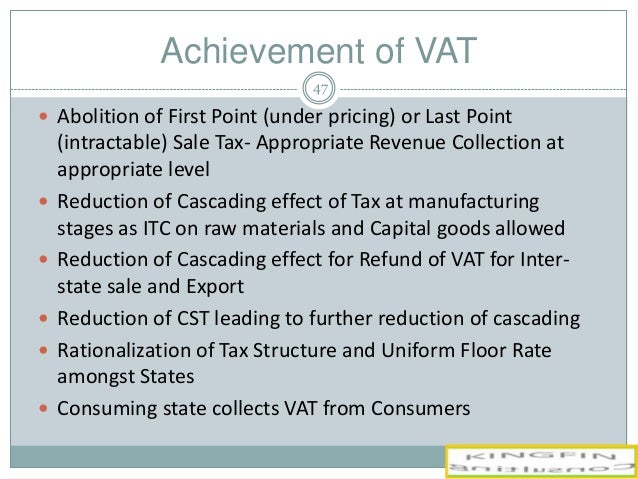

This meeting focused on analysis of revenue modification on rules of anti profiteering and gst rates on certain items coming under 28 slab rates. The 22 nd council meeting decided that ac restaurant tax rate revised to 12 from 18. Textile floor coverings and carpet gst payable in india. Under gst 5 percent for essential goods standard rate of 12 and 18 percent high rate of 28 percent and peak rate of 28 percent plus cess for luxury items the most essential goods and services attract nil rate of gst under exempted categories.

It does not constitute professional advice or a formal recommendation. Under the gst rates announced on thursday large cars with engines greater than 1 500cc and suvs with length over 4 metres and engines greater than 1 500cc are slated to attract 15 per cent cess. Gst rates of services. Revised threshold for composition scheme as on 11 06 2017.

The details about gst rate changes for sale of carpets and other textile floor coverings are being updated here. Classification scheme for services under gst. Carpets and other textile floor coverings falls under hsn code chapter 57 of gst commodity tariff schedule. The new rates will come into effect from august 1 2019.

Gst rate on electric vehicles slashed from 12 to 5. Major changes in the gst rates businesses with turnover up to inr 1 5 crore. List of services under reverse charge. The gst rates on milling industry products i e.

Four tier gst final with 5 as floor rate 28 at peak says arun jaitley the council chaired by union finance minister arun jaitley decided to fix the 5 per cent duty on mass consumption items and a 28 per cent rate on items such as packaged consumer goods.