Floor Plan Lending Ucc

As each individual new car is shipped to the dealer it is an industry standard practice that the manufacturer drafts the.

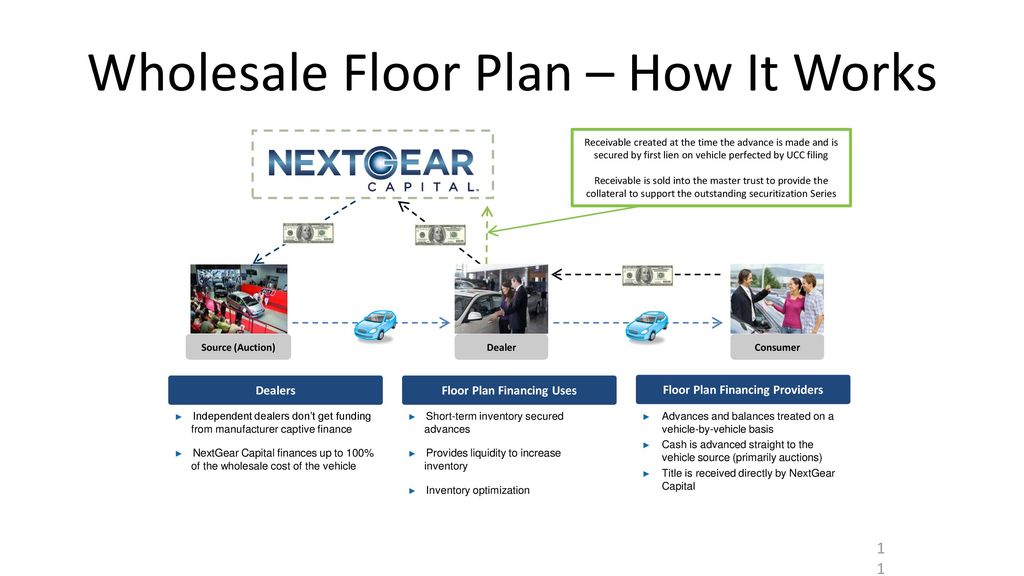

Floor plan lending ucc. Although the lender filed a ucc 1 financing statement to perfect its lien the floor plan loan agreement also required all original vehicle title documents to be transferred to and held by the lender. For example a dealer might be able to borrow 10 million over the year to purchase 300. The nationwide industry standard process is called floor plan lending and it works like this. The loans are often made with a one year term and based on an aggregate budget.

The dispute arose because the floor plan lender refused to turn over possession of the certificate of title. Supplementing working cash with a floor plan is a tried and true method to grow business. When a certificate of title is not transferred to the buyer the court in bank one found that a buyer s purchase of a vehicle was not sufficient. Floor plan lending is a form of inventory financing for a dealer of consumer or commercial goods in which each loan advance is made against a specific piece of collateral.

Based upon what the car dealer thinks will sell the best the new car dealer places its new car orders with the manufacturer. The debtor later filed for bankruptcy and the lender continued to hold the certificates of title after subsequent sales to consumers as a means. Uniform commercial code ucc requires a bank to enter into a security agreement with the. In order to facilitate the ability of lenders to floor plan or otherwise finance the acquisition of inventory by dealers of titled equipment the ucc in almost all states provides that filing a financing statement is the proper method of perfection d uring any period in which collateral subject to a state certificate of title law is.

Floor plan financing is also done for large appliances mobile homes and boats among other items and these products are usually sold to consumers with a financing contract. Floor planning is a form of financing for large ticket items displayed on showroom floors. This booklet addresses the risks associated with floor plan lending and discusses risk management practices for floor plan lending. Find out how nextgear capital dealers are tackling the challenges of today s market head on by properly utilizing their lines of credit.

This booklet applies to the occ s supervision of national banks and federal savings associations. For example automobile dealerships utilize floor plan financing to run their businesses.